jefferson parish property tax assessment

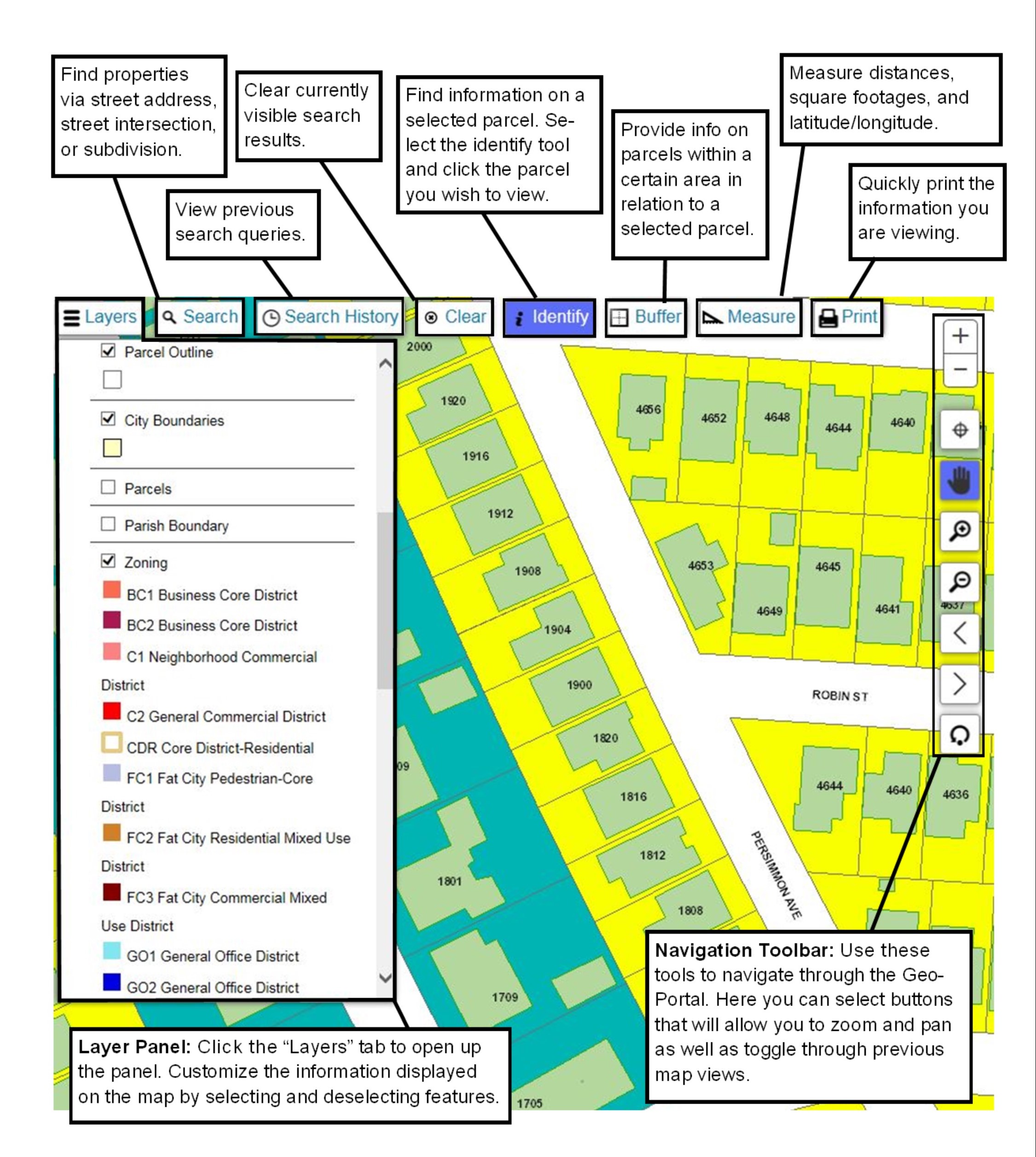

Find Jefferson Parish residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past. You can call the Jefferson Parish Tax Assessors Office for assistance at 504-362-4100.

The Assessors office is not responsible for setting millage rates.

. Jefferson County PVA Office. They are a valuable tool for the real estate industry offering both. Property values are assessed through the Jefferson Parish Assessors Office.

Remember to have your propertys Tax ID Number or. Government Building 200 Derbigny 4th Floor Suite 4200 Gretna LA 70053 Phone. This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. To qualify for the Senior Citizens Special Assessment Level Homestead Exemption freeze you must meet both of the following.

This property includes all real estate all business movable property personal property and all oil gas property and equipment. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. You must be 65 years of age or older by the end of the year.

Motor vehicles are generally taxed in the county of registration as of the assessment date. Millages. The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes.

Once the preliminary roll has been approved by the Louisiana Tax Commission the 2022 assessments will be updated on the website. 20 rows Jefferson Parish Assessors Office Jefferson Parish Assessor. Welcome to the Jefferson Parish Assessors office.

They are maintained by various government offices in Jefferson Parish Louisiana State and at the Federal level. Please call 504-362-4100 and ask for the personal property department if you have any questions. Jefferson Parish Assessors Office - Property Search.

Once the preliminary roll has been approved by the Louisiana Tax Commission the 2022 assessments will be updated on the website. If property owners continue to approve new millages your taxes will continue to increase. If a Homestead Exemption HEX is in place you would then subtract 7500 75000 HEX x 10 from the assessed value to get the taxable amount.

Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. This gives you the assessment on the parcel. All automobiles trucks boats boat trailers motorcycles and recreational vehicles must be assessed as of January 1 of each year.

Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. The preliminary roll is subject to change. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

200 Derbigny St Suite 1100. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Seniors Special Assessment. When contacting Jefferson Parish about your property taxes make sure that you are contacting the correct office.

Free Jefferson Parish Assessor Office Property Records Search. Welcome to the Jefferson Davis Parish Assessor Web Site. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10.

The preliminary roll is subject to change. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. If the parcel does not have a HEX then the.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Jefferson Parish. For comparison the median home value in Jefferson Parish is 17510000.

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

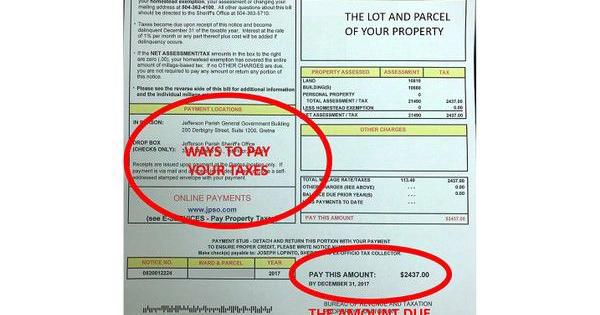

Payments Jefferson Parish Sheriff La Official Website

Property Tax Payment Options Jefferson County Tax Office

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

What Jp Residents Need To Know To Pay Property Tax

Hurricane News And Information

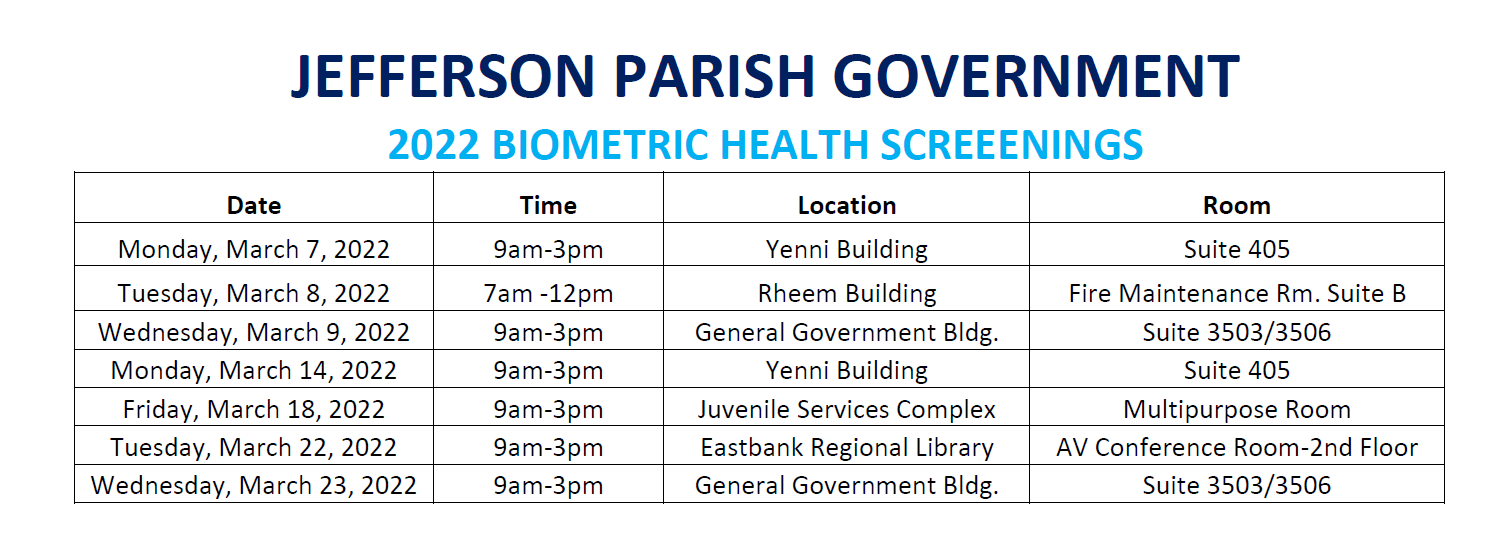

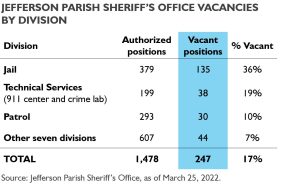

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

Tax Records Could Offer Surprisingly Rich Details About Your Ancestors Genealogy Resources Genealogy Help Family Genealogy

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog

Tax Records Could Offer Surprisingly Rich Details About Your Ancestors Genealogy Resources Family History Quotes Genealogy Help