maryland tax lien payment plan

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Ad Honest Fast Help - A BBB Rated.

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Ad BBB Accredited A Rating.

. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. However for longer-term tax payment plans the Comptroller could file a. 100 Money Back Guarantee.

Most taxpayers will be asked to repay the full balance. Default is person Person. Get Your Options Today.

State law requires each Countys Collector of Taxes to sell these tax liens to. A tax lien may damage your credit score and can only be released when the back tax is paid in full. Make credit card tax payments through the Comptroller of Marylands official site.

If you file electronically and pay by check or money. You can pay your Individual Maryland taxes with a personal check or money order if you prefer not to pay electronically or with a credit card. A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means.

You can apply for a Maryland state tax payment plan by indicating that you need a payment plan when responding to your state tax bill. Make a credit card payment. Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A.

Taxpayers who owe past-due state taxes may be able to qualify for a. If you already have a tax lien taxpayers can set up a 60-month payment plan with. End Your IRS Tax Problems - Free Consult.

Pay your personal income tax estimated personal income tax extension income tax sale and use tax. You may use this service to set up an online payment agreement for your Maryland personal income tax. You owe 25000 or less if you owe more than 25000 you may pay.

Welcome to the Comptroller of Marylands Online Payment Agreement Request Service. Select Popular Legal Forms Packages of Any Category. For payment plans under six months the Comptroller will typically not file a lien against the taxpayers property.

There is a 249 service charge because this is processed via. If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at mvaholdmarylandtaxesgov by calling the. A lien is a debt attached to your property like a mortgage.

Taxpayers can apply for this program online or when responding to their. County-specific local charges can be added to this lien. All Major Categories Covered.

Ad Help for Taxpayers Discover the options available to settle your tax debt. Make a personal estimated payment - Form PV. Dont Let that Lien Hold Back Your Financial Future.

Make a personal extension payment - Form PV. Ad Use our tax forgiveness calculator to estimate potential relief available. Select the appropriate radio button to search cases by Person or Company.

End Your IRS Tax Problems - Free Consult. A maryland tax payment plan may be available if you have a state tax liability that is beyond your means. Ad BBB Accredited A Rating.

Ad Affordable Reliable. Maryland Judiciary Judgment and Liens Search. Trusted Methods Excellent Tax Team.

Pdf Investing In Tax Liens A Primer For Financial Planners

Federal Tax Lien What Do You Do With Irs Tax Lien Delia Tax Attorneys

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)

Tax Lien Foreclosure Definition

Notice Cp504b What It Means How To Respond Paladini Law

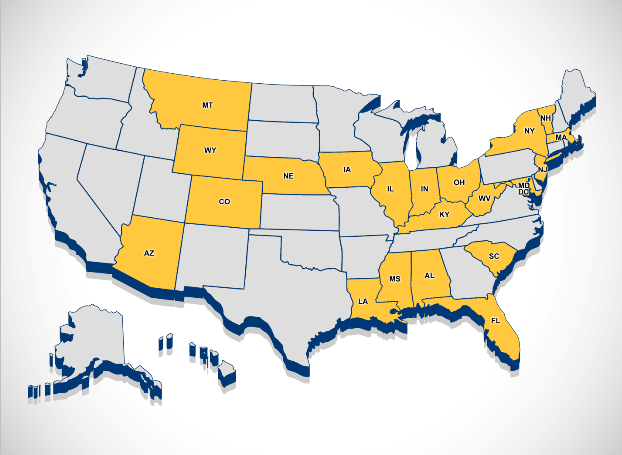

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

5 12 3 Lien Release And Related Topics Internal Revenue Service

Irs Letter 1038 Response To Inquiries About Release Of Federal Tax Lien H R Block

How To Avoid A Maryland State Tax Lien

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Taxpayers Should Beware Of Property Lien Scam Julie Jason

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

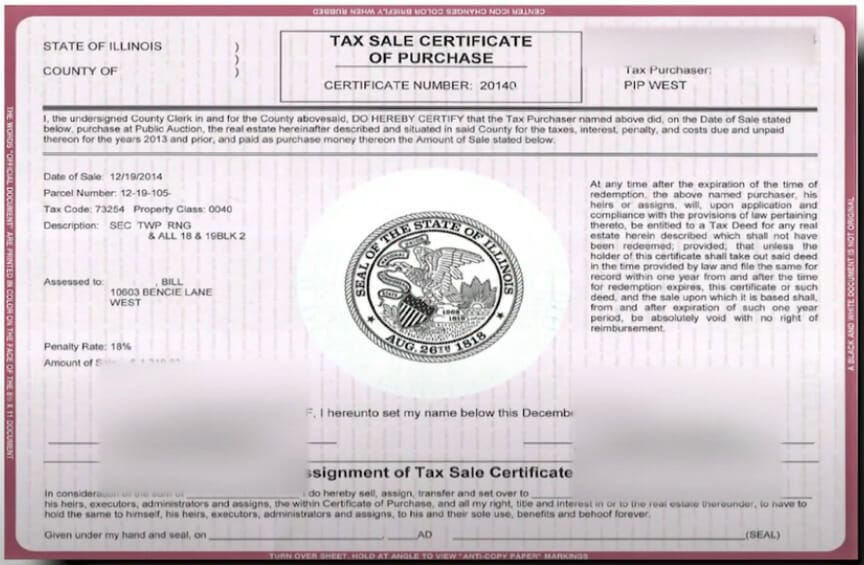

Tax Lien Certificate Definition

Fortunebuilders 3 Day Workshop Bonuses Real Estate Business Plan Real Estate Contract Real Estate

Make Money With Tax Liens Know The Rules Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas